The nature of work has changed rapidly over the past two decades. This new generation of workers are trading the stability of a traditional workplace for unconventional hours and intermittent revenue streams in order to have the flexibility and freedom to customize their work around their lives.

While the debate as to whether this is a healthy and sustainable practice is still to be completely challenged, we can’t ignore the fact that we need to the level of financial protection and security for this evolving dynamic of workers.

It’s a bit of a delicate system we have in place for the gig economy, and the scary truth is that some people are a just a bicycle accident away from the poverty line. We need to start catering to the needs to this changing workforce and accept how the definition of ‘traditional employment’ is being altered.

This is a brand new work paradigm – and one that could very likely change the nature of business altogether.

A changing of the times

When you look at the U.S numbers, freelancers, side-hustlers and independent contractors now account for more than a third of the U.S. workforce. Some studies predict the majority of American workers will be freelancers within a decade.

The standard form of employment is dramatically being shifted away from typical 9-5 corporate jobs to juggling several gigs, contracts and side hustles.

While the gig economy is still working through its growing pains, the concern regarding the level of financial protection and long-term security for benefits is still a massive question mark on the horizon that is directly tied to a healthy economy.

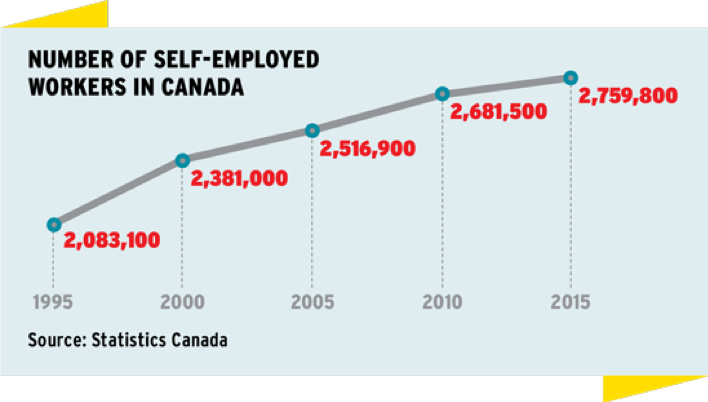

These numbers show the level of entrepreneurs is continually on the rise in Canada.

Report: Will a portable benefits plan be unrolled to Canadian gig workers?

There was a recent report highlighting the need for a portable benefits plan and how it would fill the needs of workers engaged in part-time or temporary work who have limited or no access to benefits and pensions. It would also provide employees with some flexibility because it would be tied to them individually, rather than to one employer.

Are there not as many permanent employees in order to cut costs?

Absolutely. An employer can offer health and dental to a contractor if they open up the benefits plan to them – but you can’t get disability coverage and you can only get a flat amount of life insurance.

From a disability perspective, you’re really taking a risk there, if you don’t have some supplemental coverage on your own. Even if your employer really wants to help you out with disability coverage, legally they can’t because you’re an independent contractor. A portable benefits plan is worth discussing, but there would be implications for employers if they were asked to contribute directly to the plans or pay indirectly through tax. And now employers are starting to look at providing employees benefits through health-care spending accounts.

“In Canada, one of the things we see is employers moving away from permanent employment to contract employment, and one of the reasons is to avoid the payroll costs [such as] CPP and EI and also benefits,” says Andrew Cash, a former Toronto NDP MP.

The harsh truth is that the government isn’t going to do anything

Healthcare is a provincial thing, it’s not a federal thing, and it’s up to each provincial government to hold their own.

I really believe that the Ontario government should be considering the feasibility of a portable benefits plan for employees, but just the fact that we’re seeing OHIP+ being scaled back, and having it done so quickly without it being thought all the way through means they aren’t going to go out of their way to increase costs to cover the gig economy.

They are obviously scaling back on a lot of things, and especially in light of the recent shake up announcement, there’s a lot of concern around things being privatized even more. The more we look at what the Ontario government is actually trying to do given their track record, we’re seeing that they are less and less likely to do something for the gig economy – and everyone will be on their own to fend for themselves.

I wouldn’t be holding my breath expecting this cabinet to actually come up with a solution on this – as much as it would really help.

My recommendations on how to protect yourself

Get coverage to protect yourself and your family before it’s too late.

You can’t get the coverage after the fact, and sadly, a lot of people don’t realize this is a huge exposure until something happens to them or close to them and then they realize they need to do something.

Contract workers can’t afford to be reactive – they have to be proactive to think about the potential exposure.

A lot of these individual plans will only cover new conditions going forward, so while you might get some relief through OHIP, it’s likely you’re going to have to get help from private solutions. There are products for individual health now, but a comprehensive government-endorsed product that covers all areas isn’t going to happen.

When you take a step back and look at this from a macro level, it’s incredibly compelling and powerful stuff. Rather than looking at this as transient workers doing what they can to get by or avoiding giving in to the corporate world, it’s amazing to see this as a big entrepreneurial step in folks taking control of their professional narrative.

In order for this to work long-term, we should nurture this model and enable this new breed of workers to make money on their own terms, while providing the infrastructure for a sustainable future.

Toronto, ON, Canada

Toronto, ON, Canada