With summertime on the horizon, temperatures are heating up, and excitement levels throughout the benefits industry are sky-high as the annual names of Canada’s top insurance providers are now revealed.

The highly anticipated list of Canada’s top-performing insurance companies is an excellent tool for gauging the overall potency of the industry, as well as indicating potential shifts in industry trends and growth.

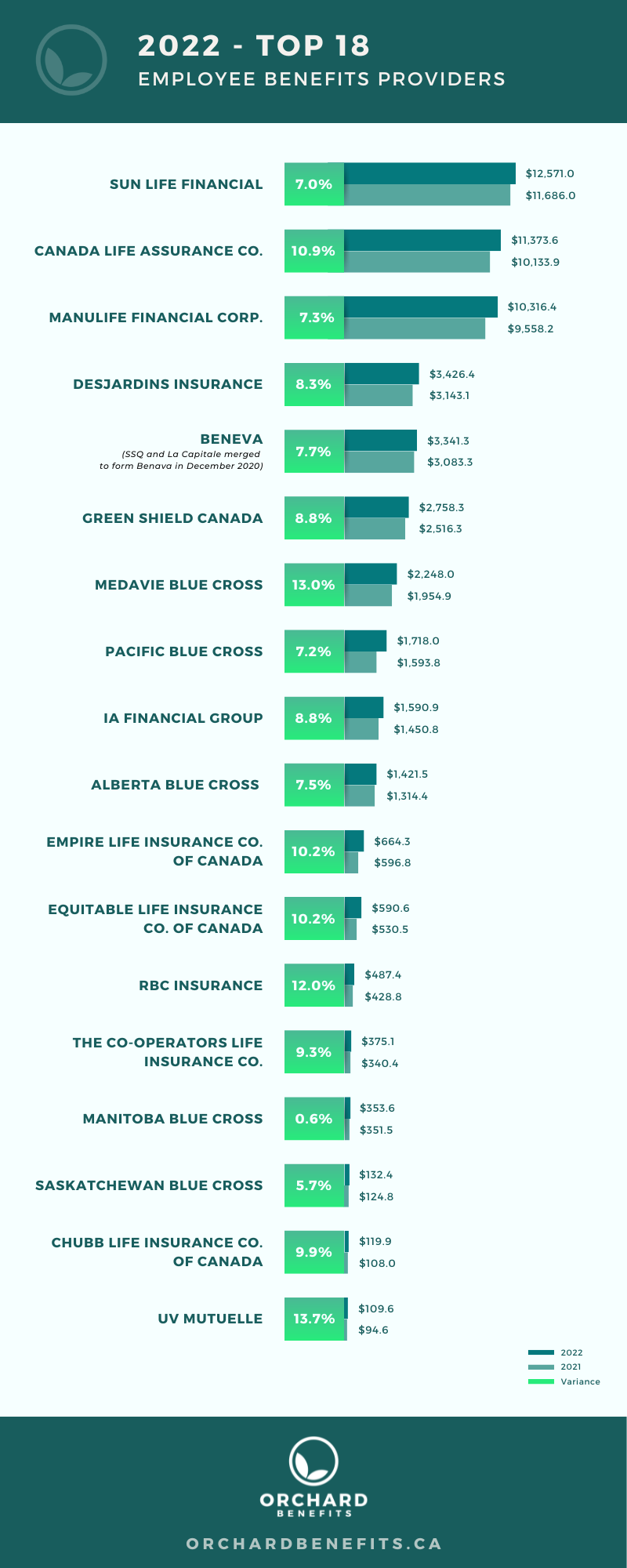

Take a look at the numbers from 2022:

Consolidation Cooled Off Significantly in 2022

Last year, one of the most significant shifts in the insurance industry was the noticeable drop in mergers and acquisitions, including the consolidation of insurers – a stark contrast to the incredible amount of activity observed in 2021. In response to rapid inflation that hit a 40-year high, most insurers opted to tighten their budgets in mid-2022 and hold off on high-cost transactions. For perspective, in 2021, US and Bermuda transactions totaled $57 billion compared to just under $18 billion in 2022. Unpredictable inflation and interest rates, increasing capital costs, and uncertain transaction financing costs all played a major role in buyers and sellers deciding to pull back and wait for calmer tides.

The Forecast is Looking Bright

Current economic forecasts anticipate that the insurance mergers and acquisitions market will recover in late 2023 into 2024 due to downward trending inflation and more settled interest rates. The US Federal Reserve Board has indicated that interest rate increases will occur in smaller increments compared to 2022, easing companies into more comfortable positions to deploy capital for acquisitions.

A Modern Approach to Modern Times

Innovation from group insurers will be key to offset potential challenges in late 2023 into 2024. Amid shifting economic and lifestyle dynamics, many insurers are developing strategic partnerships with other providers and third-party vendors to offer more direct and meaningful service solutions that reflect the changing needs of the current workforce.

Toronto, ON, Canada

Toronto, ON, Canada