Did you know that 4 in 5 Canadian workers worry about finances at work? On top of that, half of them say they would be more productive at work if they were less worried.

Transform Employees Lives With the Marmot Solution.

Financial stress can take a toll on your team. Marmot Benefits helps you provide a debt relief solution to give your employees the financial wellness support they need to be more engaged, motivated, and happier on the job. Improved employee loyalty decreases business expenses and enhances productivity, which is why Marmot’s modern debt relief strategies can make a meaningful difference to you and your employees.

Debt Relief Makes Employees More Productive

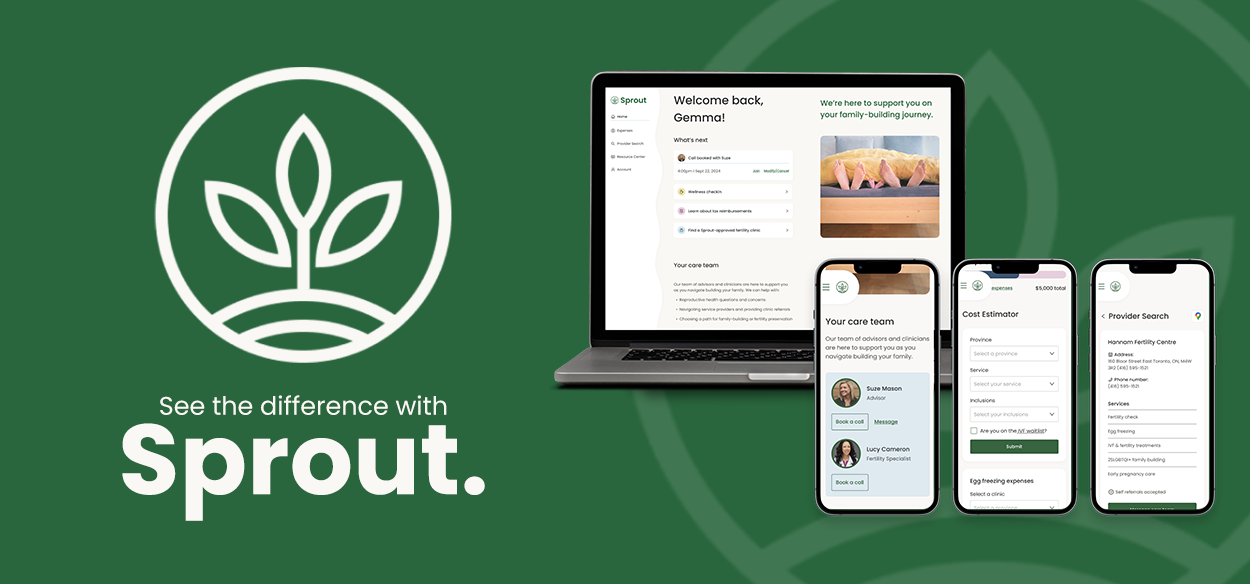

Marmot Benefits helps your employees pay down Canadian Student Loans or Canadian Residential Mortgages for total financial wellness. Marmot brings a seamless and secure integration with payroll systems to leave minimal work for HR teams.

Invest in your team’s financial well-being with these simplified debt related benefits:

- Repayment Benefit: Start with a savings plan enhancement that creates flexible contributions – some to savings, some to student loan repayment.

- Retirement Benefit: Prioritize employee long-term savings with a plan that gives retirement savings during periods of student loan repayment.

- Flexible Benefit: Prioritize employee financial wellness and create affordability with monthly student loan payments.

- Retention Benefit: Promote employee retention with a rewards program that gives benefit credits in return for hours worked.

Empower your employees with access to their savings plan benefit today when they need it most, and take advantage of multiple opportunities to re-imagine your rewards program with simplified debt-related benefits for employees.

Toronto, ON, Canada

Toronto, ON, Canada